CryptoCortex

The most advanced platform for primary and secondary markets of digital assets and cryptocurrencies

Key Features

Manage Users and Accounts

An advanced, highly customizable, open, distributed, big, fast, and reliable traders management system with flexible permissions model and multi-tenant support. Store up to 10M traders and never forget trader data. Support of a custom hierarchical organization structure with flexible permissions model.

Proprietary Matching Engine

Ultra-low latency matching engine for exchanges and dark pools with customizable risk management, smart order routing and custom executions algos support.

Risk Management

Flexible and advanced central pre- and post-trade risk management system. Execution risk management with the support of order validation, calculation of margins, order state management. Accounting risk processor for managing account balances and margins.

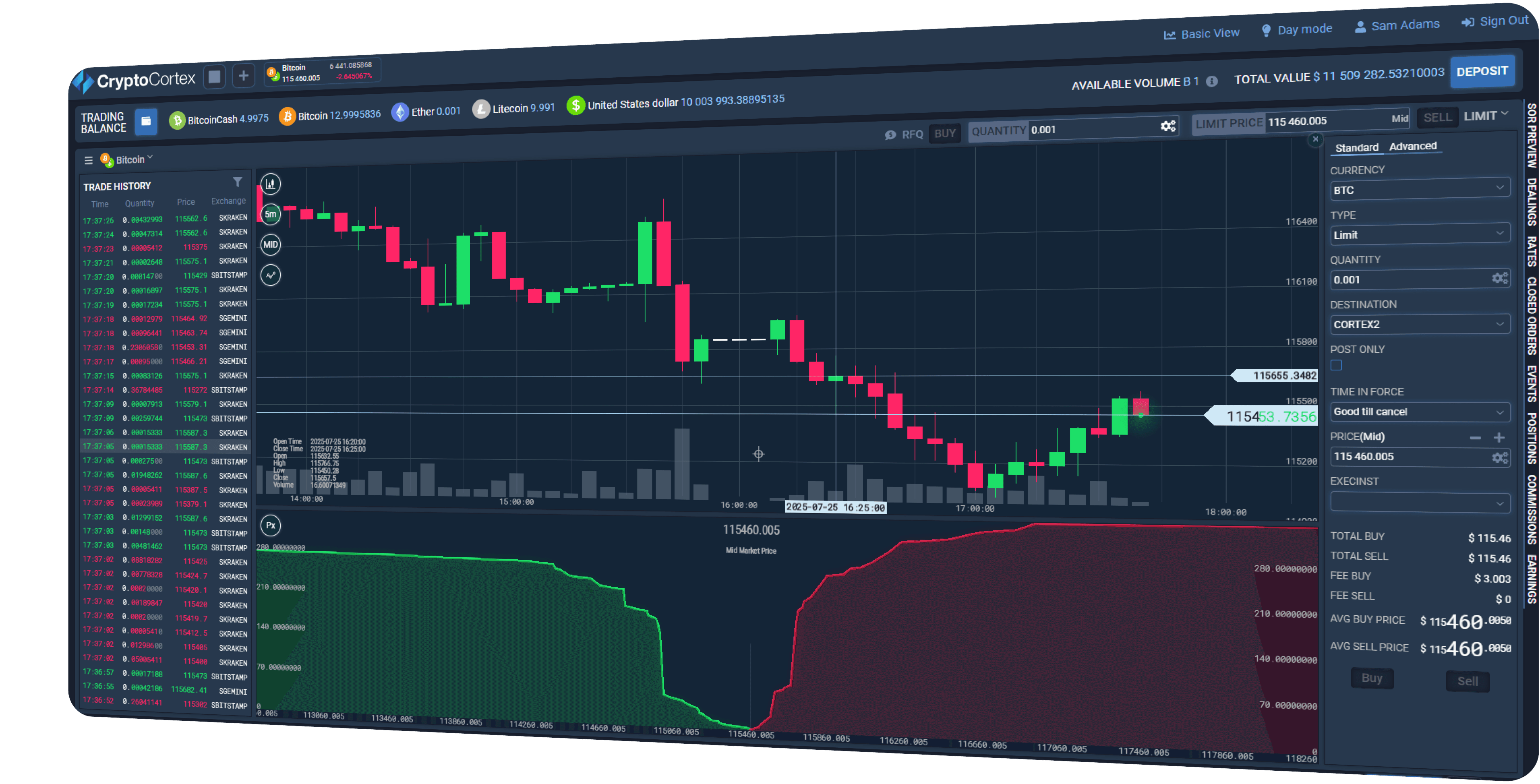

White-Label Web UI

Traders and admins can enjoy an intuitive, highly-customizable and white-label Web interface with desktop, tablet and mobile resolution support. Featuring all industry-standard analytical and trading instruments.

Integrations with External Services

The system offers out-of-the-box integrations with external custody providers (BitGo, Fireblocks), API for integration with KYC solutions, AML platforms (Chainalisys), identity providers (Auth0, Ory Hydra, Keycloak, Okta).

FIX Hub

CryptoCortex technology allows sending and receiving trading and market data to/from various system components using proprietary dialect of industry-standard FIX Protocol.

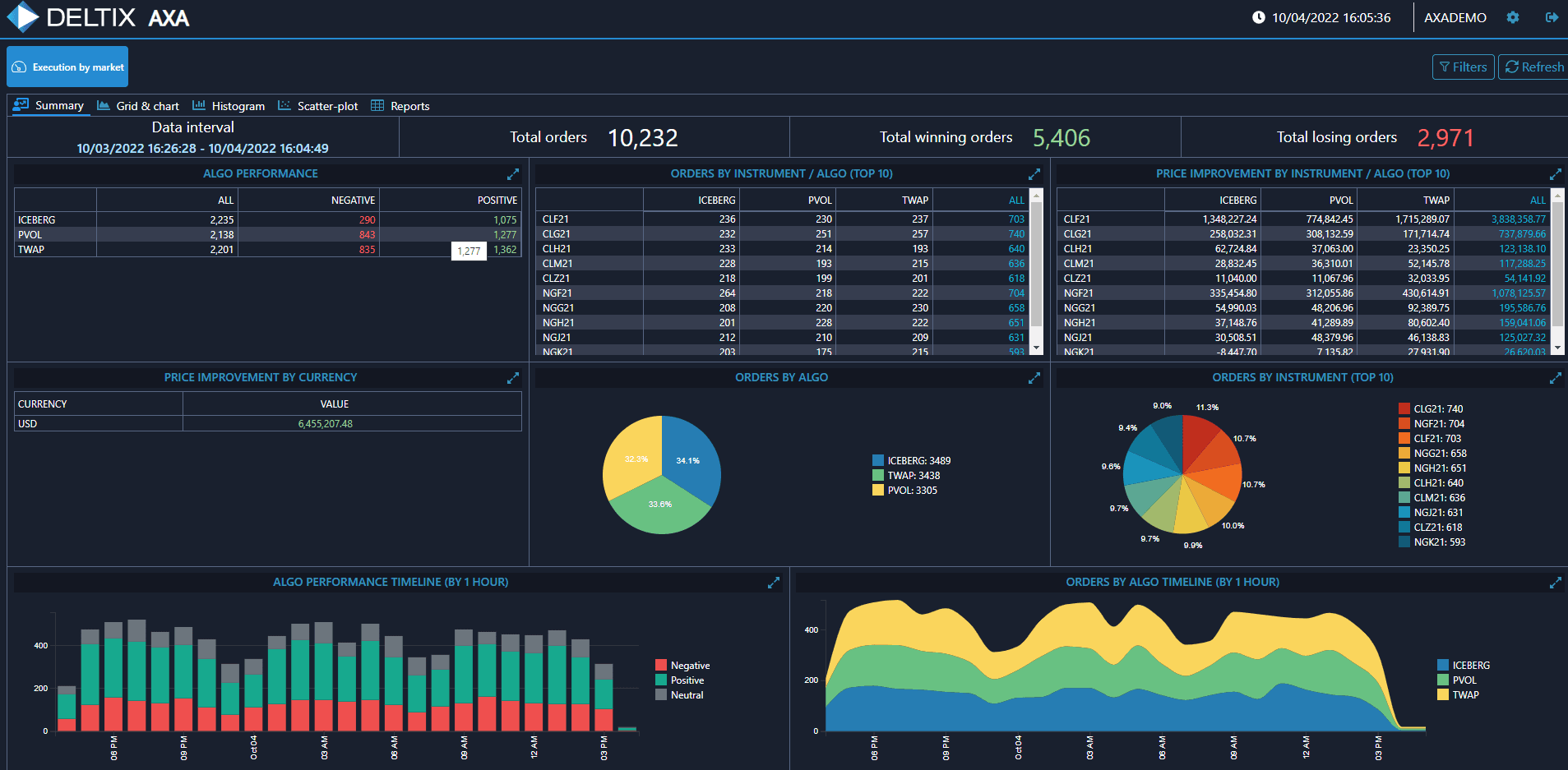

Advanced Algo Orders

The platform support various order types (bracket, linked, training) out-of-the-box, smart order routing (SOR), offers functionality to develop, back-test and optimize custom order execution algorithms like SOR, TWAP and other.

Trading and Market Data Connectors

System offers 100+ out-of-the-box connectors with different external venues. Trade crypto pairs on a dozen exchanges and liquidity pools that generate real trade volume.

Other Features

- Define Custom Prices: Leverage a flexible pricing engine to define custom price levels even on a trader level.

- Paper Trading: Test your ideas and fine-tune execution strategies with fully functional exchange simulator and UAT environment for trade simulation.

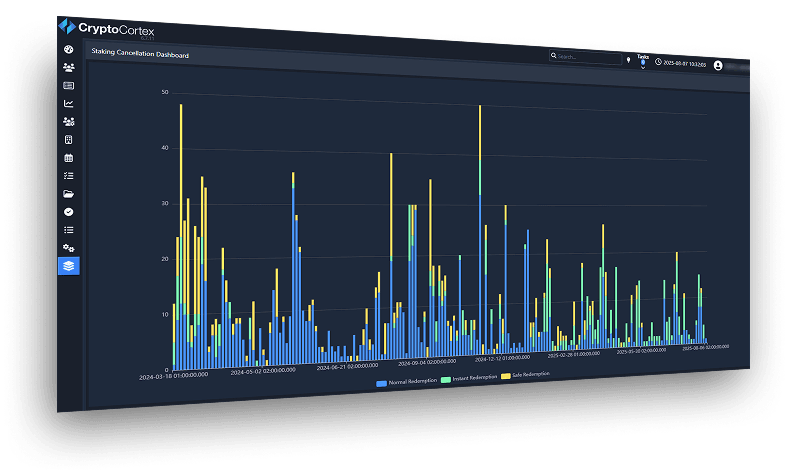

- Manage Data Streams: We offer an intuitive Web interface for streaming market data and receiving orders flow.

- Market Data Aggregation and Storage: The platform enables aggregation and streaming of a consolidated order book as well as a full-scale access to TimeBase - a high-performance, time-series warehouse, streaming and messaging system with advanced data modeling capabilities.

CryptoCortex for Secondary Markets

to schedule

a quick demo